interest restriction rules malaysia

Deduction of tax from gains or profits in certain cases derived from Malaysia 109 G. Rental income is taxed in accordance with the rules on the taxation of dividend income and interest payment ie.

Financing And Leases Tax Treatment Acca Global

Deduction of tax on the distribution of income of a family fund etc.

. Restriction on places at which wages may be paid. From any employee by way of discount interest or any similar charge on account of any advance or advances of wages made to an employee in anticipation of the regular date for the payment of wages where such advance or advances do not exceed in the aggregate one months wages. The flight route was last operated in March 2020 before international COVID-19 travel restrictions forced operators to pull the plug.

If we discover or have reasonable grounds to believe that a sporting event on which Bets are offered has been manipulated including by match fixing or there are sports integrity issues associated with your Account we will void all relevant Bets. A tax treaty between Malaysia and the recipients country of residence may reduce the rate of WHT. Semporna 30 Jun 2022 Pembelajaran murid Sekolah Kebangsaan Mabul diperkasakan menerusi Program HASiL Kasih Prihatin 2022 anjuran Lembaga Hasil Dalam Negeri Malaysia HASiL.

Nonetheless rental income is taxable in case the income is received for services that surpass that of a normal investor and these services are viewed as business. Any Bet placed in breach of the rules of the relevant sports governing body or other applicable rules will be voided. Deduction of tax on the distribution of income of a unit trust 109 E.

Deduction of tax on the distribution of income of a unit trust 109 E. Deduction of tax from interest paid to a resident 109 D. Deduction of tax from interest paid to a resident 109 D.

Deduction of tax on the distribution of income of a family fund etc. The actual rental income received is thus not taxable. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU.

It comes as low-cost airline AirAsia resumed its popular Perth to Bali flight route at the weekend with the planes returning to WA skies for the first time since the pandemic struck. A 175 has been introduced to restrict deductions for interest expenses or any other payments which are economically equivalent to interest to ensure that such expenses commensurate with the. Taxable in box 3 see above.

Deduction of tax from gains or profits in certain cases derived from Malaysia 109 G. Interest paid or credited to any person who is not a tax-resident in Malaysia other than interest attributable to a business carried on by such person in Malaysia is generally subject to Malaysian WHT at the rate of 15 percent on the gross amount. Heres the latest on travel to and from the United States including quarantine requirements testing and rules for foreign countries.

Taxation Principles Dividend Interest Rental Royalty And Other So

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

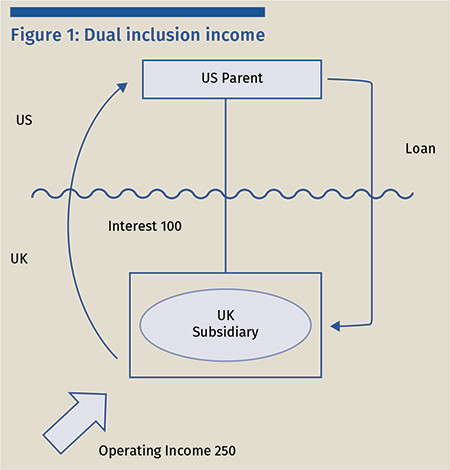

Uk Loan Structures Changes To The Anti Hybrid Rules

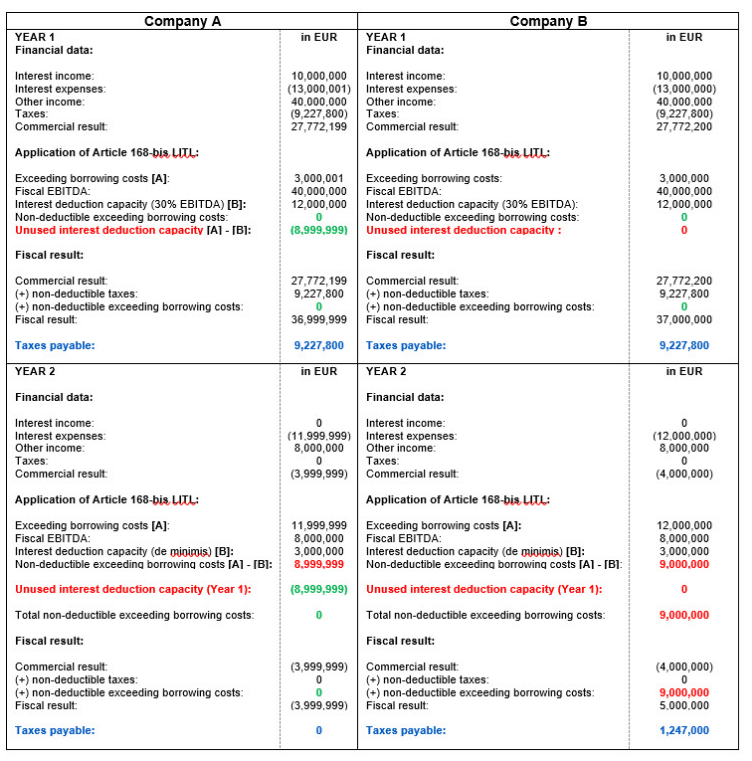

Luxembourg Interest Deduction Limitation Rule New Guidance Released By The Luxembourg Tax Authorities

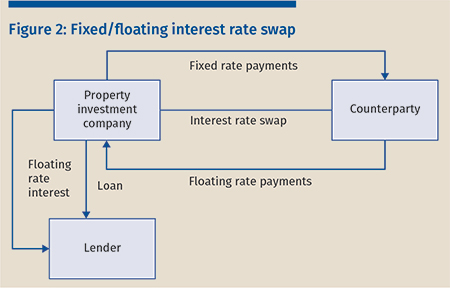

Property Investment Some Recent Developments

.jpg)

Financing And Leases Tax Treatment Acca Global

In The Matter Of Interest Crowe Malaysia Plt

In The Matter Of Interest Crowe Malaysia Plt

In The Matter Of Interest Crowe Malaysia Plt

Newsletter 30 2018 New Information Required For Company Income Tax Return Form E C For Ya 2019 Page 001 Jpg

Newsletter 35 2019 Restriction On Deductibility Of Interest Guidelines Page 001 Jpg

Taxation Principles Dividend Interest Rental Royalty And Other So

Malaysia To Impose Tighter Coronavirus Restrictions In Capital Reuters

Transfer Pricing Documentation Guide 2022 Crowe Malaysia Plt

In The Matter Of Interest Crowe Malaysia Plt

Transfer Pricing Documentation Guide 2022 Crowe Malaysia Plt

No comments for "interest restriction rules malaysia"

Post a Comment